Mississippi tax cut plan: Alive, then dead, then alive again

Published 4:37 pm Tuesday, March 16, 2021

JACKSON (AP) — A proposal to overhaul Mississippi’s tax structure was killed in the Senate but then revived in the House on Tuesday — a dispute that creates conflict as legislators enter the final weeks of their annual session.

Tuesday was the deadline for the Senate to keep House Bill 1439 alive. The bill proposed phasing out Mississippi’s income tax and cutting the 7 percent state grocery tax in half. It also proposed increasing the sales tax on most items from 7 percent to 9.5 percent and increasing taxes on other items, including tobacco, alcohol, farm implements and manufacturing equipment.

Senate Finance Committee Chairman Josh Harkins, a Republican from Flowood, said he was letting the bill die without bringing it up for a vote. Harkins said legislators need more time to evaluate the potential impact of decreasing some tax rates and increasing others. He said the House and Senate could hold hearings this summer.

“I just want to make sure whatever we do is responsible,” Harkins said Tuesday.

Within hours, though, the House revived most of the tax plan by putting it into Senate Bill 2971 — a bill originally written to authorize the state to borrow money for repair and renovation projects at universities.

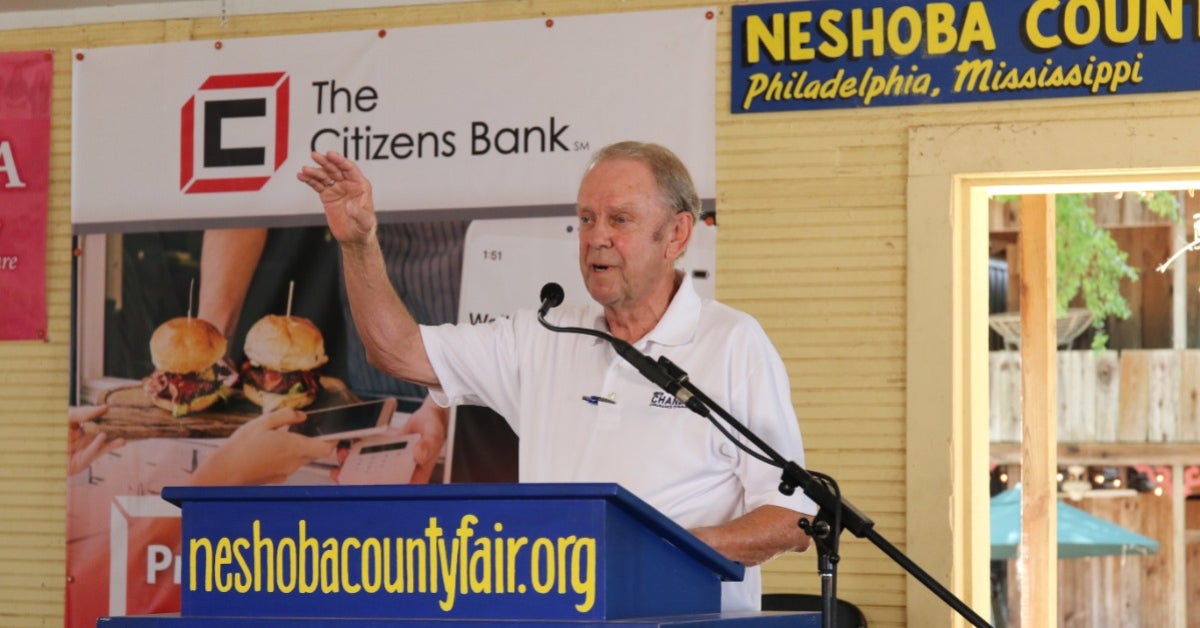

“Unfortunately, the Senate, for now, has punted the ball on the singular most impactful legislation before us this year,” House Ways and Means Committee Chairman Trey Lamar said about the tax plan. “It’s time for bold action, and it’s time to continue to fight.”

Lamar, a Republican from Senatobia, said the revived House plan would erase most — but not all — of the personal income tax. He also said the revived plan no longer included new taxes on loggers, farmers or manufacturers.

House Speaker Philip Gunn and his allies introduced House Bill 1439 on Feb. 22, and it moved through the House Ways and Means Committee that day. It passed the GOP-controlled House the next day on an 85-34 vote that was largely along party lines, with only a few Democrats supporting it and only one Republican opposing it.

Gov. Tate Reeves is pushing legislators to phase out Mississippi’s personal income tax.

A federal coronavirus relief package signed by President Joe Biden last week prohibits states from using federal relief money to pay for tax cuts. But the Mississippi tax cut plan originated weeks before the federal legislation was signed, and Harkins said the federal package did not affect his decision to kill the state plan.

Mississippi tax collections for the first eight months of the current budget year — July through February — were higher than for the same period a year earlier.

Gunn and other supporters of the bill say it could help Mississippi compete with states that already don’t have a personal income tax, including Texas and Florida.

Public policy groups have lined up for and against Mississippi tax cut proposals. Empower Mississippi is among the conservative groups that have said phasing out the income tax would reward productivity. The left-leaning Center on Budget and Policy Priorities has said four of the five states that made deep cuts to personal income taxes in the first half of the 2010s later lagged behind national averages in job growth and personal income.